In 2019 licensed by the Securities Commission MyStartr was recognised as an equity crowdfunding ECF platform too. Invest halal or raise capital for your business with Malaysias first Shariah-compliant Equity Crowdfunding platform.

Securities Commission Malaysia Advances Greater Inclusivity In Promoting Equity Crowdfunding Crowdfund Insider

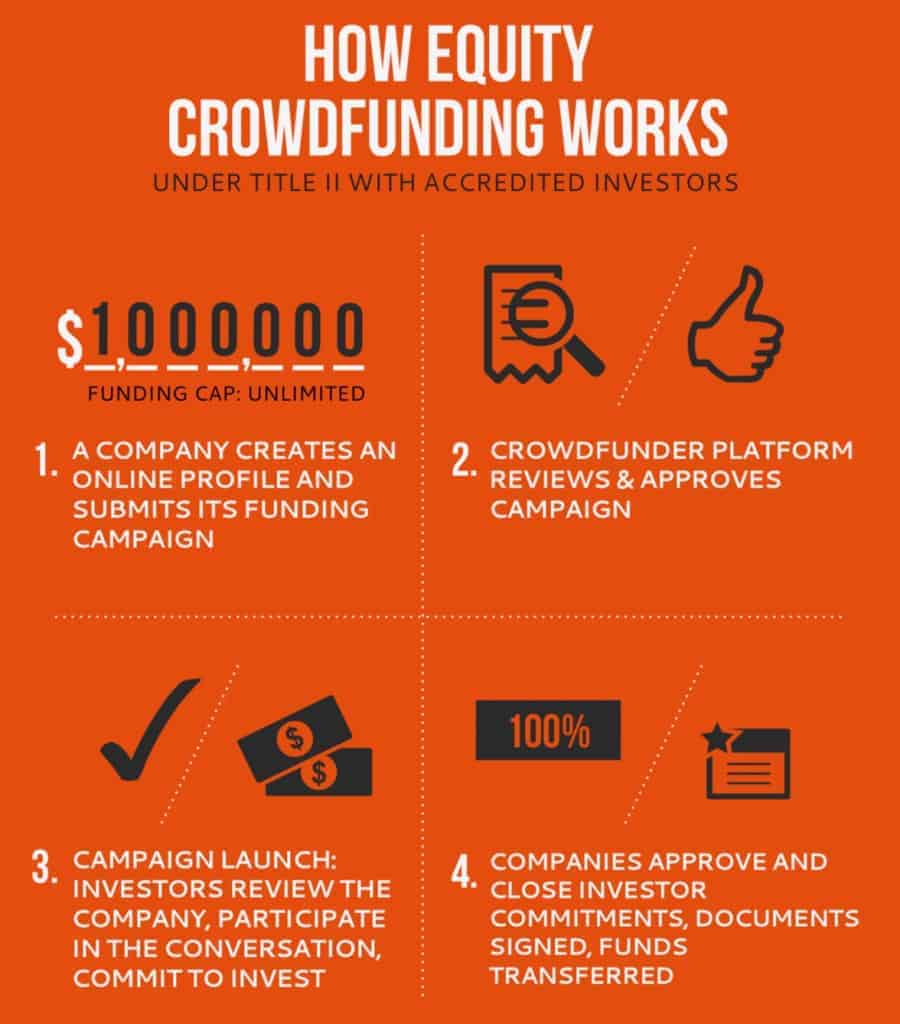

A ECF is an online fundraising platform for start-ups or micro small and medium enterprises MSMEs to raise early stage financing from a group of investors.

. The Security Commission Malaysia awarded an Equity Crowdfunding license to Mystartr in May 2019 and launched our platform in December 2019. Ethis Malaysia is a Securities Commission Malaysia approved Shariah compliant. Significant milestones include being awarded as a licensed Equity Crowdfunding Operator by Securities Commission of Malaysia organising over 100 Neo Marketing related workshops within 24 months and successfully reaching out to over 300 SMEs and 3000 participants.

Ethis Malaysia which is part of Ethis Group is a Recognized Market Operator RMO approved under Securities Commission Malaysia to carry out Equity Crowdfunding business activities. Ten ECF platforms have been registered to date. LATEST FROM ETHIS.

Securities Commission Malaysia SC has organised the first equity crowdfunding forum in Malaysia bringing together over 600 entrepreneurs and investors to create public awareness on the potential of equity crowdfunding as an alternative channel to raise capital. These platforms are called Recognised Market Operators. This goes to pay for their operational costs in running the ECF platform.

To protect the integrity of the Malaysian capital markets and to ensure adequate protection for retail investors the Securities Commission has imposed a regulatory framework for equity crowdfunding platforms. 1337 Ventures Ethis Ventures and MyStartr. The six platforms are Alix Global Ata Plus Crowdonomic Eureeca pitchIN and Propellar Crowd.

Investors who provide financing to the start-up or MSME via ECF will receive equity or shares from the company and will become one of the shareholders of the company. We are best known for our crowdfunding impact investment for Indonesian social housing development projects which has been operational since 2014. Equity crowdfunding ECF is an innovative form of alternative fundraising that allows small businesses to raise capital from the public using online platforms registered with the Securities Commission Malaysia SC.

Malaysia crowdfunding regulations. Locally the Securities Commission of Malaysia only allows approved platforms to offer equity crowdfunding. Malaysia was the first country from the ASEAN region to create regulations with a specific focus on equity crowdfunding and its evolution.

In Malaysia the Securities Commission of Malaysia SC is the regulatory body regulating ECF related activities. There was a significant increase in 2018 mainly contributed by P2P crowdfunding raising close to RM180 million 2017. In the US there are currently.

Your one-stop for ECF. Currently the Securities Commission of Malaysia SC only allows legal structures such as private companies and limited liability partnerships formed in Malaysia to participate in crowdfunding. The new equity crowdfunding players are.

Click HERE to find out Securities Commission Malaysia. The Securities Commission of Malaysia SC regulates equity crowdfunding as an alternative way to raise funds. Examples of Recognised Market Operators RMO.

The Securities Commission of Malaysia has allowed ECF operators to charge a certain percentage on the amount raised. For example if you raise RM3m the ECF operator will charge 7 RM210k as their fee. Since its introduction 50 SMEs have raised RM 4887 million through equity crowdfunding.

Securities Commission Malaysia today announced 3 new licenses for equity crowdfunding and 5 for P2P lending. The ECF therefore is a framework that enables start-ups and SMEs to access market-based financing through a platform registered with the Securities Commission Malaysia SC. Within a year we had successfully funded 14 projects and raised RM19700000 with an average 150 investors per campaign.

Ethis Malaysia which is part of Ethis Group is a Recognized Market Operator RMO approved under Securities Commission Malaysia to carry out Equity Crowdfunding business activities. Global Fintech News including Crowdfunding Blockchain and more. More than half of the investors on the platform are retail investors signalling a.

This new batch sees names that are familiar to those in the startup scene and some new names. Laws and Regulations The government announced that the current fundraising limit imposed on crowdfunding campaigns has been increased from RM10 mil to RM20 mil. RM37 million growing 375 year-on-year while ECF reported negative growth in the same period.

So far we have helped companies raise more than RM 64 Million. Nonetheless funds raised from ECF increased exponentially in the following two years recording a growth of 59 year-on-year in. Securities Commission Malaysia Home Malaysian ICM Click here to download the latest issue Corporate Governance Strategic Priorities 2 021-2023 Click here to find out more.

The main crowd investing regulatory bodies are the Securities Commission Malaysia SC Malaysia and the Bank Negara Malaysia Malaysias central bank. In addition to that the Securities Commission has set rules and guidelines that must be followed by all approved platforms. Companies with the intention to obtain fundraising through equity crowdfunding can only do so with platforms licensed by the SC.

Since then we had numerous ECF projects from small to medium sized companies with a variety of backgrounds such as platforms technology and food. It is the first country in Southeast Asia with distinct regulations for equity crowdfunding and P2P financing platforms. SC selects six platforms for equity crowdfunding in Malaysia THE Securities Commission Malaysia SC has announced the approval of six registered equity crowdfunding platforms giving small businesses and entrepreneurs greater access to capital.

This is standard in the ECF industry. Currently the Securities Commission of Malaysia SC crowdfunding guidelines only allow legal structures such as private companies and limited liability partnerships formed in Malaysia. For investors The ECF will enable investors to be a shareholder of such start-ups and SMEs and diversify their investments beyond the traditional asset classes.

PitchIN is registered with the Securities Commission of Malaysia as a Recognized Market Operator RMO for the. Currently there 7 players operating in the equity crowdfunding space in Malaysia with Fundnel being the latest to be granted a license by Securities Commission Malaysia.

The State Of Equity Crowdfunding Malaysia

Investing Through Equity Crowdfunding Pros Cons Ethis

The Risks Rewards Of Equity Crowdfunding In Malaysia For Business Owners Investors Entrepreneur Campfire

Pdf Equity Crowdfunding In Malaysia Legal And Sharia Challenges

Challenge Of Islamic P2p Crowdfunding 4 Regulatory Issues Of All The Download Scientific Diagram

How Can Malaysian Leverage On Equity Crowdfunding

Equity Crowdfunding Ecf In Malaysia Nexea

The Securities Commission Malaysia Approves Edgeprop As First Property Crowdfunding Platform In Malaysia Crowdfund Insider

Securities Commission Malaysia Crunchbase Company Profile Funding

Equity Crowdfunding Ecf In Malaysia Nexea

Sc Registers Three Digital Asset Exchanges Mystartr Crowdfunding In Malaysia

An Alternative Investment Equity Crowdfunding Ecf In Malaysia Mcsb

Equity Crowdfunding Ecf In Malaysia Nexea

Sc Lifts Equity Crowdfunding Fundraising Limit The Edge Markets

Fundedbyme Awarded Coveted Asian Peer To Peer Allowances By Securities Commission Malaysia Pepins

Crowdfunding Malaysia P2p Ecf Home Facebook

Equity Crowdfunding Ecf In Malaysia Nexea

Equity Crowdfunding Ecf In Malaysia Nexea

Securities Commission Malaysia Advances Greater Inclusivity In Promoting Equity Crowdfunding Crowdfund Insider